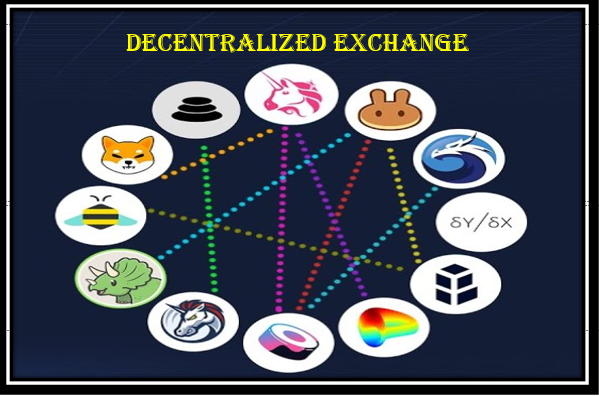

Decentralized exchanges are becoming increasingly popular in the cryptocurrency world. There are many benefits to using a decentralized exchange (DEX), including increased security and privacy, as well as the ability to trade directly with other users without the need for a third party.

However, there are also some drawbacks to using a DEX, including the lack of liquidity and the lack of customer support.

In this article, we will take a look at the pros and cons of decentralized exchanges and whether or not they are a good option for trading cryptocurrencies.

What is a Decentralized Exchange?

A decentralized exchange is an exchange that does not rely on a third party to hold or manage the funds being traded. Instead, trades are made directly between users through an automated process.

The most popular DEX is EtherDelta, which is built on the Ethereum blockchain. Other popular decentralized exchanges include Waves Dex and Bitshares.

Benefits of Decentralized Exchanges

There are many benefits to using a decentralized exchange.

Increased security

When you trade on a centralized exchange, you are trusting the exchange to keep your funds safe. However, on a DEX, your funds are stored in your own personal wallet, which you control. This means that you are not at risk of losing your funds if the exchange is hacked or goes bankrupt.

Increased privacy

When you trade on a centralized exchange, your personal information is typically required. However, on a DEX, you can trade anonymously.

[Ability to trade directly with other users]

On a centralized exchange, you are typically only able to trade with other users who are also using that exchange. However, on a DEX, you can trade directly with any other user, regardless of which exchange they are using.

No need for a third party

When you trade on a centralized exchange, you are trusting the exchange to act as a middleman and facilitate the trade. However, on a DEX, there is no need for a third party, as the trade is made directly between users.

Drawbacks of Decentralized Exchanges

There are also some drawbacks to using a decentralized exchange.

[Lack of liquidity]

Decentralized exchanges typically have lower liquidity than centralized exchanges. This means that there may be less buyers and sellers available, and the prices may be less favorable.

[Lack of customer support]

When you trade on a centralized exchange, you have the Exchange’s customer support team to help you if you have any problems. However, on a decentralized exchange, there is no customer support team, and you will need to rely on the community for help.

Conclusion

Decentralized exchanges have many benefits, including increased security and privacy. However, they also have some drawbacks, such as the lack of liquidity and customer support. Overall, decentralized exchanges are a good option for those who are looking for more security and privacy when trading cryptocurrencies.